Faith Based (and all other) Nonprofit Recipients Should Disclose Why They Applied and What They Received in PPP Funds

How do you feel about Edmond-based LifeChurch.TV receiving in the category of $5-10 million in taxpayer funds? How about the $2-5 million for the Hobby Lobby owner-supported Museum of the Bible? Or the millions received collectively by conservative Christian colleges in Oklahoma? Or various Catholic entities (a national story last week said the Catholic Church, collectively, received $1.4 billion, including in dioceses that have paid out massive sums to settle child abuse cases)? Or how about the hundreds of thousands received by United Methodist entities, (including Boston Avenue in Tulsa, which I attend), and Presbyterian organizations, and Jewish and (at least one) Muslim institutions?

I’m still sorting through my thoughts and feelings.

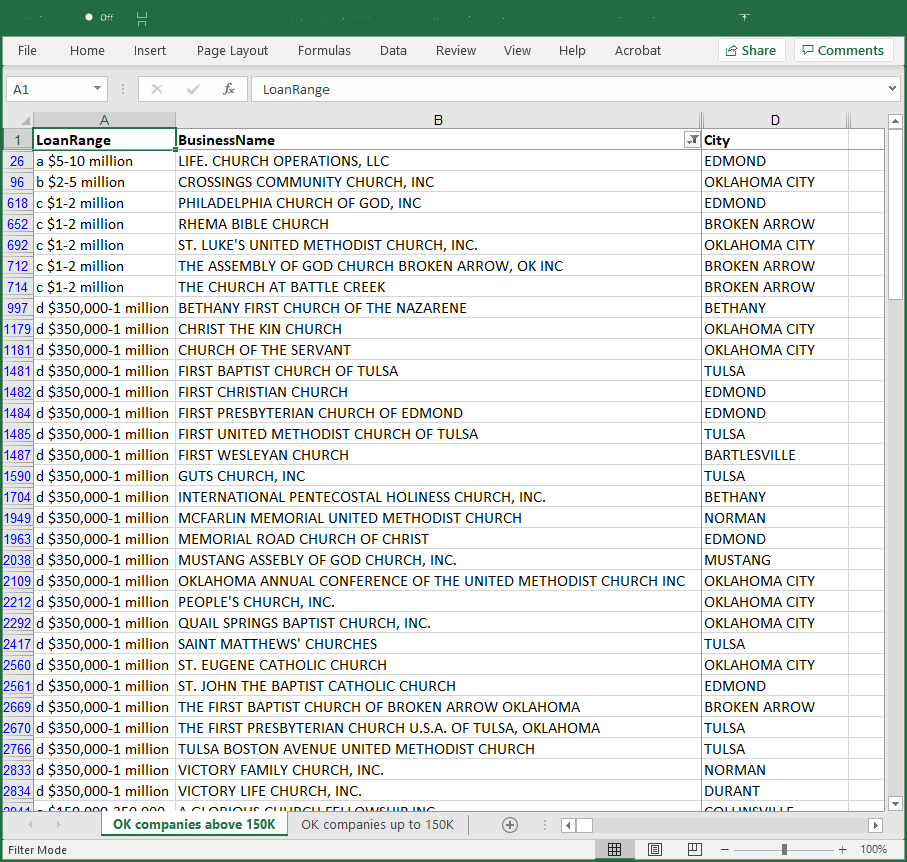

Screenshot of the PPP spreadsheet filtered for a business name containing the word “church.”

Last week, I extracted the categories of loans-by-dollar of faith-based nonprofits in Oklahoma that received at least $150,000 in the Paycheck Protection Program (PPP). (You can see the full database of all organizations that received at least $150 thousand on the Small Business Administration website. The names of organizations that received smaller amounts are not publicly available. I pulled the Oklahoma faith-based list from the spreadsheet on the SBA site.) I then created a Facebook post in the Center for Religion in Public Life group (which is open to the public to join) as well as on my personal page. The list I created is also at the bottom of this blog post.

Seeing the list and the dollar categories caused strong reactions from Facebook commentators. Strong negative reactions. “Evil.” “Greedy.” “Appalling.”

Nonprofits, take notice, please. I think you have a requirement, and you certainly have an opportunity, to make your “case for support” in public.

Admittedly, my initial reactions were also negative. There were organizations on that list whose missions and values I reject. Some fund recipients work for values I find abhorrent. But my negative reactions weren’t limited to organizations I did not like. Houses of worship, schools, and service providers I admire are recipients too.

I also looked in the national list for some of the graduate seminaries I know best. There was my alma mater, Garrett-Evangelical. There is Union in New York City. And there, too, was Princeton Theological Seminary. Despite being supported by a billion-dollar endowment, Princeton applied for and received funds in the $2-5 million category. (The administration and board at Phillips Theological Seminary, my employer, after thorough discussion, declined to apply.)

Some commentators on last week’s post offered a helpful, broader perspective than those who reacted negatively. They rightly said: “In Oklahoma, much social service work is done through faith-based organizations. These organizations have employees. The PPP was intended to help keep employees employed by covering 2.5 months of salary and utilities. Some of these organizations run food pantries, day cares, pre-schools, end-of-life care, ministries with families of incarcerated persons, and schools. Who knew how the pandemic shutdowns would affect giving? And then there was tuition not being collected.”

All true.

So, here’s where sorting my thoughts and feelings has led me.

First, it is important to acknowledge the new elements of this government assistance program: this is the first time that a SBA program was open to nonprofits. The opening to nonprofits raised the First Amendment establishment clause issue of whether or not to include or exclude faith-based nonprofits. The decision was to include them.

In past times, the idea of a government, taxpayer, national-debt-increasing federal program paying the salaries of priests, rabbis, imams, ministers, and the like would have been anathema. But with the conservative shift in the courts, with the U.S. Supreme Court ruling that states cannot bar faith-based schools from receiving state funding if the state allows secular private schools to receive funding, these are not past times. And we have a president who fires up his base by the wall he wants to tear down—between church and state. In addition, one of his surrogates assured the president’s religious supporters that they would be included in PPP funds.

Now, in truth, Mr. Jefferson never got his “wall” per se. The wall of separation, never mentioned in the Bill of Rights per se, was Swiss-cheesed from the start. Today the holes are growing, especially for a highly conservative brand of Christianity. In the case of PPP, the holes were opened for all religious 501c3 groups.

As readers of this blog know, I prefer more rather than less of a wall between church and state. I am passionate about the need to guard our faith symbols and stories from being misused by the state, regardless of which administration is in power.

Seeing all these religious groups funded by the federal government, at the same time the Supreme Court is ruling in favor of religious schools receiving state funding, on the one hand, and barring “ministers,” now much more broadly defined, from suing their employers for discrimination, on the other hand—along with nearly every other action and stunt this president and his allies have taken/pulled that reduced the integrity of religion—well, all this leaves me feeling sick to my stomach and worried about what else comes through this enlarged church-state hole.

That wall is crumbling down. Because of the youth and conservative bent of judges appointed both by Presidents George W. Bush and Donald Trump, even if the administration changes color from red to blue, church-state cases are going to be decided by non-separationists for a long time.

Setting aside my objection to the program based on church-state matters: I know the leaders of faith-based institutions were worried, rightly so, regarding what a shutdown would mean for them. They care about their employees, and in a nonprofit personnel costs are often most of their budget because their people are their programs. Large nonprofit operations, faith-based or not, have many employees and, therefore, high payrolls.

It does not take long for a $60,000 compensation package, multiplied by 50 employees for 2.5 months, to add up quickly to real money. Few nonprofits have substantial reserves to cover a few months, and precious few have long-term investments to draw from for an indeterminate amount of time. One of the lessons I learned serving as a seminary president for nine years is that, regardless of how liberal or conservative an employee is, at the end of the day, everyone wants to be paid!

With these reasons in mind, it would seem reasonable and proper for all nonprofits to apply for funds.

I would bet some boards and administrations also reasoned that it is their fiduciary responsibility to do all in their power to secure funding for their school. With that reasoning, leaving money on the table that might otherwise aid their organization is unethical. Yeah, I’m not buying that one. We are not talking about donors, or disputed wills. We are talking about taxpayer dollars in a limited fund that, huge as it was, was insufficient to cover the requests of the businesses that applied. There were more or less needy organizations. More or less. And it is highly likely that some with “more” shut out those with “less.”

What are the unintended consequences of taking these funds? Religious organizations walked through the open door, opened by the state, of a different relationship between religious institutions and the state. Anyone who thinks that relationship will always benefit religion, that all the walking and requirements are in one direction, that there won’t be any quid pro quos, has not read history, or is not allowing what we know about history to trouble their justifications for taking this money.

Here comes my biggest complaint, and I really hope nonprofits in general and religious nonprofits in particular, will address this matter: the secrecy about who applied, who received, and how much was received needs to end.

Ever since the Enron scandal and the resulting Sarbanes-Oxley legislation, nonprofits have been required to be more transparent about funding, how their CEO compensation is determined, and to develop and follow conflict of interest and ethics policies. Secular nonprofits are required to file with the IRS a disclosure document named the 990 (you can review the 990 of any secular nonprofit, for free at Guidestar). Religious nonprofits are not required to file, although some voluntarily do so.

For the sake of transparency and earning public trust, the SBA should have disclosed the exact amount each organization received. And for the sake of transparency and earning public trust at a time when the religiously-affiliated population of the U.S. is decreasing and public officials have contributed mightily to public cynicism, every receiving organization should disclose why they applied and what they received. These are public dollars, loaned by the federal government (more on that below). These funds have greatly increased the government debt. Who pays that debt? Will it be paid in this generation or will it take generations to pay this debt, as often happens after a war?

Every receiving organization ought to publish on its website the reasons for asking for the money, the amount received, and furnish a report on how the funds were used. Anything less will make these loans-that-will-become-grants feel even more icky.

Last point. Whom should be thanked, and what form should thanking take? If the organizations used the loans as intended, the loan becomes a grant. In the nonprofit world, a grant is a kind of a gift. And the gifting entity is owed thanks, as well as an accounting for how the gift was used.

Who should be thanked? Congress? The American people? The President seeking re-election at all costs and his door-opening allies? And what form does thanks take? Swag? Not useful. (Who needs tens of thousands of key chains, shopping bags, or coffee mugs?) Thank you notes? Plausible. Quid pro quos? Ah, government money comes with strings! Now we’re in a political game. A political game that involves government, religion, and money—what could go wrong?

Dr. Gary Peluso-Verdend is president emeritus at Phillips Theological Seminary and is the executive director of the seminary’s Center for Religion in Public Life. The opinions expressed in this blog are those of the author. Learn more about the Center’s work here and about Gary here.

(Author’s note: I would welcome other attempts to create an accurate list. Since I was judging which entities belonged on the list by name, I may have included or excluded some organizations in error.)

a $5-10 million LIFE. CHURCH OPERATIONS, LLC

b $2-5 million CROSSINGS COMMUNITY CHURCH, INC

b $2-5 million MID-AMERICA CHRISTIAN UNIVERSITY, INC

b $2-5 million OKLAHOMA BAPTIST UNIVERSITY

b $2-5 million OKLAHOMA CHRISTIAN UNIVERSITY, INC.

b $2-5 million ROMAN CATHOLIC DIOCESE OF TULSA

b $2-5 million SOUTHERN NAZARENE UNIVERSITY

b $2-5 million THE BAPTIST CONVENTION OF THE STATE OF OKLAHOMA

b $2-5 million THE MUSEUM OF THE BIBLE

b $2-5 million VICTORY CHRISTIAN CENTER INC

b $2-5 million WILLIE GEORGE MINISTRIES, INC

c $1-2 million OKLAHOMA BAPTIST HOMES FOR CHILDREN, INC.

c $1-2 million A NEW LEAF, INC.

c $1-2 million ARCHDIOCESE OF OKLAHOMA CITY

c $1-2 million BISHOP KELLY HIGH SCHOOL, INC

c $1-2 million BISHOP MCGUINNESS HIGH SCHOOL

c $1-2 million OKLAHOMA CHRISTIAN SCHOOLS, INC.

c $1-2 million OKLAHOMA CONFERENCE CORPORATION OF SEVENTH-DAY ADVENTISTS

c $1-2 million OKLAHOMA WESLEYAN UNIVERSITY, INC

c $1-2 million PHILADELPHIA CHURCH OF GOD, INC

c $1-2 million RHEMA BIBLE CHURCH

c $1-2 million ST. LUKE’S UNITED METHODIST CHURCH, INC.

c $1-2 million MONTE CASSINO SCOOL, INC

c $1-2 million THE ASSEMBLY OF GOD CHURCH BROKEN ARROW, OK INC

c $1-2 million THE EPISCOPAL DIOCESES OF OKLAHOMA, INC.

c $1-2 million THE VOICE OF THE MARTYRS, INC.

c $1-2 million TULSA CHRISTIAN EDUCATION CORPORATION

c $1-2 million TULSA JEWISH COMMUNITY RETIREMENT AND HEALTH CARE CENTER, INC

c $1-2 million UNITED METHODIST HOME OF ENID, INC

d $350,000-1 million BACONE COLLEGE INC

d $350,000-1 million BETHANY FIRST CHURCH OF THE NAZARENE

d $350,000-1 million CATHOLIC CHARITIES OF THE ARCHDIOCESE OF OKLAHOMA CITY INC.

d $350,000-1 million CATHOLIC CHARITIES OF TULSA

d $350,000-1 million CHRIST THE KIN CHURCH

d $350,000-1 million CHRISTIAN HERITAGE ACADEMY

d $350,000-1 million CHURCH OF THE SERVANT

d $350,000-1 million CITY RESCUE MISSION, INC.

d $350,000-1 million CONGREGATION B’NAI EMUNAH

d $350,000-1 million CORDELL CHRISTIAN HOME

d $350,000-1 million CRISTO REY OKLAHOMA CITY CATHOLIC HIGH SCHOOL, INC

d $350,000-1 million DESTINY CHRISTIAN SCHOOL INC

d $350,000-1 million FIRST BAPTIST CHURCH OF TULSA

d $350,000-1 million FIRST CHRISTIAN CHURCH

d $350,000-1 million FIRST PRESBYTERIAN CHURCH OF EDMOND

d $350,000-1 million FIRST UNITED METHODIST CHURCH OF TULSA

d $350,000-1 million FIRST WESLEYAN CHURCH

d $350,000-1 million GUTS CHURCH, INC

d $350,000-1 million HEARTLAND BAPTIST BIBLE COLLEGE INC

d $350,000-1 million JOHN 3:16 MISSION

d $350,000-1 million KIRK OF THE HILLS CORPORATION

d $350,000-1 million LUTHERAN SENIOR CITIZENS INC

d $350,000-1 million MCFARLIN MEMORIAL UNITED METHODIST CHURCH

d $350,000-1 million MEMORIAL ROAD CHURCH OF CHRIST

d $350,000-1 million MOUNT SAINT MARY HIGHSCHOOL

d $350,000-1 million OKLAHOMA ANNUAL CONFERENCE OF THE UNITED METHODIST CHURCH INC

d $350,000-1 million OKLAHOMA CHRISTIAN ACADEMY

d $350,000-1 million OKLAHOMA UNITED METHODIST CIRCLE OF CARE, INC

d $350,000-1 million ORAL ROBERTS EVANGELISTIC ASSOCIATION, INC.

d $350,000-1 million PEOPLE’S CHURCH, INC.

d $350,000-1 million QUAIL SPRINGS BAPTIST CHURCH, INC.

d $350,000-1 million SAINT MATTHEWS’ CHURCHES

d $350,000-1 million SOUTHWEST COVENANT SCHOOLS, INC.

d $350,000-1 million SOUTHWESTERN CHRISTIAN UNIVERSITY, INC.

d $350,000-1 million ST. EUGENE CATHOLIC CHURCH

d $350,000-1 million ST. JOHN THE BAPTIST CATHOLIC CHURCH

d $350,000-1 million ST. KATHARINE DREXEL RETIREMENT CENTER, INC.

d $350,000-1 million THE ACADEMY OF CLASSICAL CHRISTIAN STUDIES, INC.

d $350,000-1 million THE FIRST BAPTIST CHURCH OF BROKEN ARROW OKLAHOMA

d $350,000-1 million THE FIRST PRESBYTERIAN CHURCH U.S.A. OF TULSA, OKLA.

d $350,000-1 million TULSA BOSTON AVENUE UNITED METHODIST CHURCH

d $350,000-1 million VICTORY CHRISTIAN CENTER, OKLAHOMA CITY INC.

d $350,000-1 million VICTORY FAMILY CHURCH, INC.

d $350,000-1 million VICTORY LIFE CHURCH, INC.

e $150,000-350,000 FCC CHILD DEVELOPMENT CENTER

e $150,000-350,000 MCFARLIN CHURCH DAYCARE

e $150,000-350,000 VICTORY LIFE ACADEMY, INC

e $150,000-350,000 A GLORIOUS CHURCH FELLOWSHIP INC.

e $150,000-350,000 ALL SOULS EPISCOPAL CHURCH

e $150,000-350,000 ALL SOULS UNITARIAN CHURCH

e $150,000-350,000 ARROW HEIGHTS BAPTIST CHURCH, INC.

e $150,000-350,000 BARTLESVILLE FIRST UNITED METHODIST CHURCH

e $150,000-350,000 BISHOP JOHN CARROLL SCHOOL

e $150,000-350,000 BLESSED SACRAMENT CHURCH

e $150,000-350,000 BLESSINGS INTERNATIONAL

e $150,000-350,000 BOARD OF TRUSTEES OF CAMPS AND CONFERENCES OF THE OKLAHOMA ANNUAL CONFERENCE OF THE UNITED METHODIST CHURCH

e $150,000-350,000 CHURCH OF THE HARVEST OF AMERICA, INC.

e $150,000-350,000 CITY CHURCH OF BARTLESVILLE

e $150,000-350,000 CLAREMORE ** FIRST BAPTIST CHURCH OF CLAREMORE

e $150,000-350,000 COUNCIL ROAD BAPTIST CHURCH

e $150,000-350,000 COVENANT LIVING OF BIXBY

e $150,000-350,000 EMMANUEL BAPTIST CHURCH OF ENID, OKLAHOMA

e $150,000-350,000 EMMAUS BAPTIST CHURCH

e $150,000-350,000 FAITH FREE WILL BAPTIST CHURCH, INC

e $150,000-350,000 FAITH TABERNACLE ASSOCIATION, INC.

e $150,000-350,000 FELLOWSHIP BIBLE CHURCH

e $150,000-350,000 FIRST ASSEMBLY OF GOD

e $150,000-350,000 FIRST BAPTIST CHURCH

e $150,000-350,000 FIRST BAPTIST CHURCH

e $150,000-350,000 FIRST BAPTIST CHURCH MOORE, OKLAHOMA

e $150,000-350,000 FIRST BAPTIST CHURCH OF ADA

e $150,000-350,000 FIRST BAPTIST CHURCH OF BARTLESVILLE

e $150,000-350,000 FIRST BAPTIST CHURCH OF JENKS

e $150,000-350,000 FIRST BAPTIST CHURCH OF MUSTANG, INC.

e $150,000-350,000 FIRST BAPTIST CHURCH OF NORMAN OKLAHOMA

e $150,000-350,000 FIRST CHRISTIAN CHURCH OF OWASSO

e $150,000-350,000 FIRST UNITED METHODIST CHURCH

e $150,000-350,000 FIRST UNITED METHODIST CHURCH

e $150,000-350,000 FIRST UNITED METHODIST CHURCH OF ARDMORE

e $150,000-350,000 FIRST UNITED METHODIST CHURCH OF BROKEN ARROW, OKLA.

e $150,000-350,000 FIRST UNITED METHODIST CHURCH OF OWASSO, INC

e $150,000-350,000 GOLDEN RULE INDUSTRIES OF MUSKOGEE, INC

e $150,000-350,000 GOOD SHEPHERD COMMUNITY CLINIC INC.

e $150,000-350,000 HOLY TRINITY LUTHERAN CHURCH INC

e $150,000-350,000 HOMECHURCH, INC

e $150,000-350,000 HOPE CENTER MINISTRIES

e $150,000-350,000 HOPE HARBOR, INC.

e $150,000-350,000 HOPE IS ALIVE MINISTRIES INC.

e $150,000-350,000 HOSPICE CIRCLE OF LOVE ASSOCIATION

e $150,000-350,000 HOUSE OF DAVID INC

e $150,000-350,000 JEWISH FEDERATION OF TULSA

e $150,000-350,000 KING’S GATE MINISTRIES, INCORPORATED

e $150,000-350,000 MERCY SCHOOL INSTITUTE

e $150,000-350,000 MESSIAH LUTHERAN CHURCH, INC.

e $150,000-350,000 MET CARES FOUNDATION, INC.

e $150,000-350,000 METROPOLITAN BIBLE CHURCH

e $150,000-350,000 MINGO VALLEY CHRISTIAN SCHOOL, INC

e $150,000-350,000 MINISTRIES OF JESUS, INC.

e $150,000-350,000 NEW COVENANT UNITED METHODIST CHURCH

e $150,000-350,000 NORTH CHURCH, INC.

e $150,000-350,000 NORTHSIDE CHRISTIAN CHURCH

e $150,000-350,000 OAK HALL EPISCOPAL SCHOOL

e $150,000-350,000 OKLAHOMA DISTRICT COUNCIL OF THE ASSEMBLIES OF GOD OF THE STATE OF OKLAHOMA

e $150,000-350,000 PEACE ACADEMY

e $150,000-350,000 PONCA CITY ** FIRST LUTHERAN CHURCH OF PONCA CITY, OKLAHOMA

e $150,000-350,000 PUTNAM CITY BAPTIST CHURCH INC

e $150,000-350,000 QUEST CHURCH, INC.

e $150,000-350,000 REDEEMER COVENANT CHURCH OF TULSA

e $150,000-350,000 REMERGE OF OKLAHOMA COUNTY, INC

e $150,000-350,000 RESONANCE CENTER FOR WOMEN INC

e $150,000-350,000 SACRED HEART CHURCH

e $150,000-350,000 SAINT ANN RETIREMENT CENTER

e $150,000-350,000 SAINT FRANCIS OF ASSISI CHURCH

e $150,000-350,000 SOUTHERN HILLS BAPTIST CHURCH

e $150,000-350,000 ST MARYS CATHOLIC CHURCH OF PONCA CITY OKLAHOMA

e $150,000-350,000 ST PHILIP NERI CATHOLIC CHURCH

e $150,000-350,000 ST. AUGUSTINE ACADEMY, INC.

e $150,000-350,000 ST. CHARLES BORROMEO CATHOLIC CHURCH

e $150,000-350,000 ST. FRANCIS XAVIER CATHOLIC CHURCH OF ENID, OKLAHOM

e $150,000-350,000 ST. JOHN NEPOMUK CATHOLIC CHURCH

e $150,000-350,000 ST. MARY SCHOOL

e $150,000-350,000 ST. MARY’S EPISCOPAL SCHOOL, INC.

e $150,000-350,000 FIRST UNITED METHODIST CHURCH OF STILLWATER, OKLA.

e $150,000-350,000 SUNNYBROOK CHRISTIAN CHURCH, INC

e $150,000-350,000 THE CARBONDALE ASSEMBLY OF GOD CHURCH OF TULSA OKLAHOMA

e $150,000-350,000 THE COOKSON HILLS CHRISTIAN SCHOOL

e $150,000-350,000 THE EDUCATION AND EMPLOYMENT MINISTRY, INC.

e $150,000-350,000 THE FIRST BAPTIST CHURCH OF MUSKOGEE, OKLAHOMA

e $150,000-350,000 THE GENESIS PROJECT, INC.

e $150,000-350,000 THE GOOD SHEPHERD LUTHERAN CHURCH

e $150,000-350,000 THE LOVE STATION

e $150,000-350,000 THE OKLAHOMA BIBLE ACADEMY

e $150,000-350,000 THE OKLAHOMA UNITED METHODIST FOUNDATION

e $150,000-350,000 THE PARK CHURCH OF CHRIST

e $150,000-350,000 TRANSFORMATION CHURCH

e $150,000-350,000 TRINITY BAPTIST CHURCH OF ADA OKLAHOMA

e $150,000-350,000 WESTMINSTER PRESBYTERIAN CHURCH

e $150,000-350,000 WOODLAKE ASSEMBLY OF GOD CHURCH

e $150,000-350,000 WRIGHT CHRISTIAN ACADEMY

Comments are closed.